Consolidation in Fleet Management

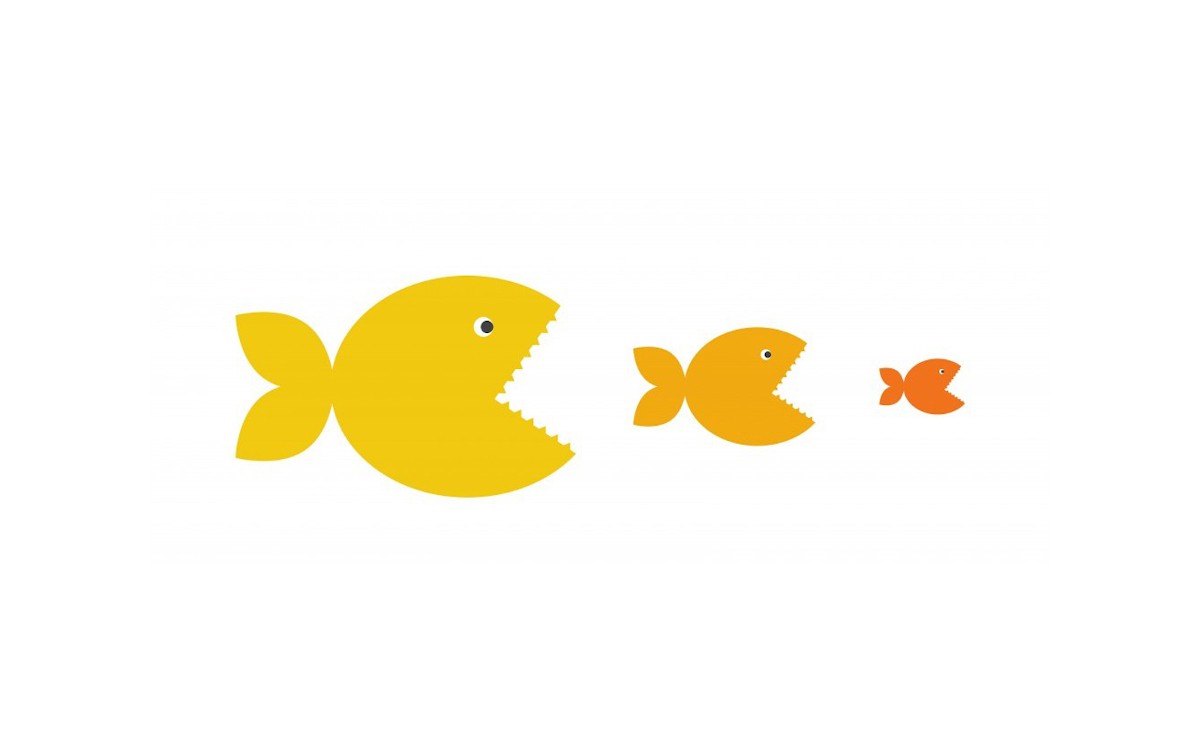

Rentacar and Fleet management companies are promising businesses with low valuation on the market. They require a lot of financial resources and some may not survive the crisis while leaders might further expand their domination.

LeasePlan and ALD Outlooks

A few days ago, LeasePlan outlook has been downgraded by Fitch (April 2020) who said: “the economic and financial market fallout arising from the coronavirus outbreak represents a clear risk, such as net losses from fleet disposals, a material drop in operating lease income, a sharp increase in impairment charges on loans and receivables or an inability to maintain adequate liquidity and funding profile due to increased refinancing risks.”

ALD has published its Q1 results this week. Operating margins continue to grow following portfolio dynamic (+5% year on year) but management has been raising provisions to cover expected losses on used car sales and potential credit default due to the economic depression. Net income remains at very high level (128 million for the quarter). After publication, ALD shares went up again but remain very attractive at 9.81 euros far below the 14.5 euros of the introduction to the market in 2017.

| Fleet management market leaders | ||

|---|---|---|

| company | shareholders | portfolio (cars) |

| Leaseplan | funds | 1,865,000 |

| ALD | Socgen (80%) | 1,765,000 |

| Arval | BNPP | 1,255,000 |

| Element | funds | 1,000,000 |

| Alphabet | BMW | 700,000 |

| Athlon | Daimler | 425,000 |

For the long term, renting is promising

Renting business, in general, whether short term (Rentacar) or long term (fleet management) is a promising business that will structurally grow as consumers will look more and more for a car to use rather than a car to own. In that context, leading operators, in particular ALD and Arval should go safely through the crisis whereas smaller operators and Rentacar businesses will face difficulties to refinance their book and offset losses on used car sale or credit default.

In a recent interview to FleetEurope, Tim Albertsen (ALD CEO) was saying: “As our main markets progressively emerge from confinement we are positioning ourselves to seize new opportunities, for instance by responding to the demand for flexible products and promoting our used car lease offer.”